By Nick Timiraos

The breakneck pace of home price growth from earlier this year appears to be slowing—and that’s not necessarily bad news for the housing market.

Home prices in June rose by 11.9% from a year ago, essentially unchanged from the year-over-year gain posted in May, according to CoreLogic. On a seasonally adjusted basis, prices in June went up by 0.6% from May, according to Capital Economics, the smallest gain in six months.

A pullback in home prices isn’t a major cause for concern, because prices are still going to rise—just not at as brisk a pace as we’ve seen over the past year. This should calm down those pundits who have fretted over a new crop of housing bubbles.

A report published last week from economists at Goldman Sachs Group offers three reasons why home price gains are likely to moderate:

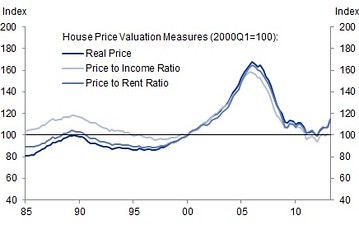

First, housing is no longer that cheap. Home prices relative to incomes and relative to rents no longer look “undervalued” as they did over the past two years. Instead, recent home-price gains have put home prices on a national basis back at “fair value.”

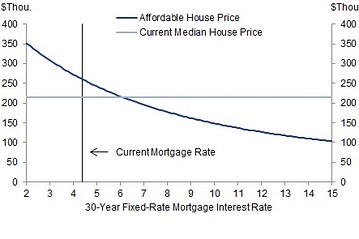

Second, a sharp spike in mortgage rates has probably led some buyers to pause. A monthly survey of real-

estate agents by Credit Suisse suggested that the “initial urgency” sparked by the jump in mortgage rates from June had subsided, “and now buyers are stepping back to re-evaluate their options,” the report said. “While agents feel some buyers have been ‘priced out,’ most think buyers are just taking a breather.” An index measuring buyer traffic fell below agents’ expectations for the first time all year, the report said: “The next few months will be crucial to determining whether this is just a pause or something more.”

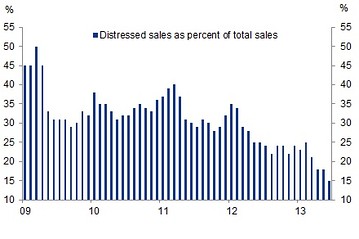

Third, some of the biggest drivers of price gains are going to play a smaller role going forward. Home price indexes have posted sharp increases in part because the share of homes selling out of foreclosure has declined. The “distressed sales” share has fallen so far that it can’t drop much lower. Investors are also slowing down their purchases in part because the bargains of yesteryear have dried up.

Rising home prices are also encouraging more sellers to test the market, putting an end to the steep inventory declines witnessed over the past two years. The number of new listings that hit the market between mid-June and mid-July in 24 metros tracked by ZipRealty increased by 14% compared with than the same period last year—the strongest year-over-year growth in listings so far this year. Normally, inventory declines between May and July, but that hasn’t been the case this year, according to the ZipRealty report.

Seven cities saw new listings between mid-June and mid-July rise by more than 20% from their year-ago levels, including Denver (26%), San Diego (24%), Seattle (24%), Orange County, Calif. (24%), and Washington, D.C. (23%).

While this should help improve supply-demand imbalances, it’s possible that many of these sellers will be in the market for another house, meaning that prices will continue to rise until there’s more new construction. “With the improving underlying housing demand driven by household formation and economic recovery, we think housing activity will remain on an upward trajectory despite occasional ups and downs along the way,” says the Goldman report.

Source: Wall Street Journal