For buyers and potential sellers alike, the most common question is, “when will there be more homes on the market?” and the most common fear is that the answer will be “they aren’t coming.” Historically, January is always a slow month for real estate, both sales and listings, so why the uncertainty now? Let’s take a look.

The “Tax Cuts and Jobs Act” has passed. With respect to residential real estate, there is a valid concern that the diminished tax incentives to homeownership will have a negative impact on the housing market. For example, with the reduced cap on deductible mortgage debt (now $750,000, prior $1,000,000), some homeowners may decide stay put to preserve their higher tax deductions, which have a grandfathered status under the new tax law. For others, the itemized state and local property tax deduction cap at $10,000 (same for both single and married filers) has a more profound impact. Both of these policies will contribute to the lack of inventory. Why would you move and take on more property taxes that you can no longer deduct? (I do have to give a shout out to the NAR for holding onto our capital gains exemption for a principal residence if lived in for 2 out of 5 years. The original legislation wanted to change this to 5 out of 8 years with a phase out for high income earners.)*

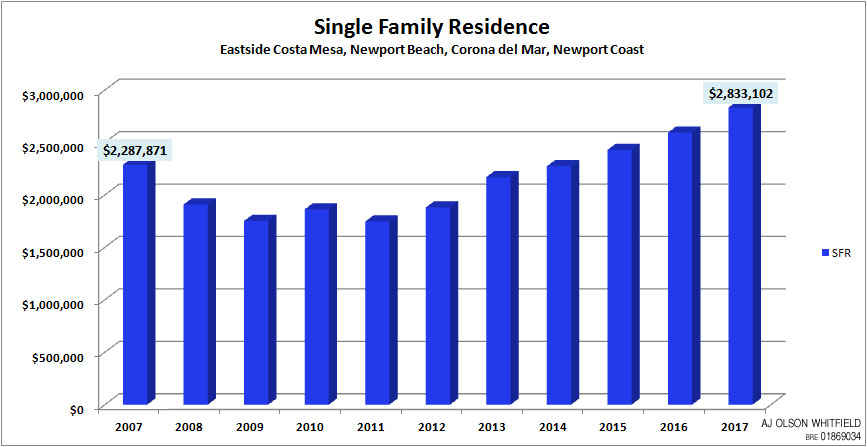

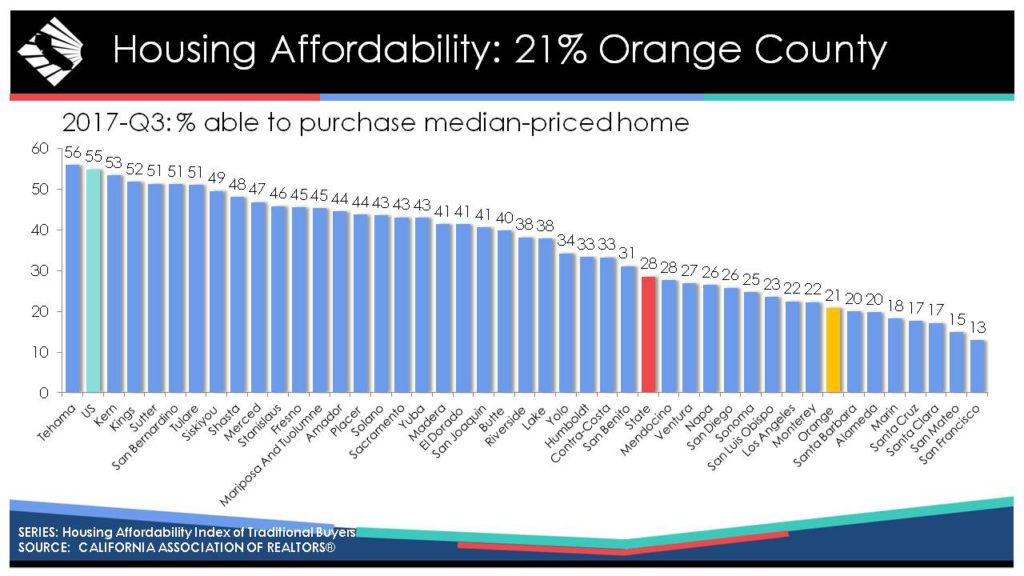

Affordability is the next area of examination. In our local market, defined as Newport Beach, Eastside Costa Mesa, Corona del Mar and Newport Coast, we ended 2017 with an aggressive growth of 10% in our average sales price of a single family home. It currently costs a buyer $2,833,102 on average to enter this market, that is 23% higher than our last market highpoint in 2007. * When you take a look at the chart below, Orange County has a 21% affordability rate only yielding to a few high profile bay areas.

Let’s look at current housing supply. When priced competitively, current listings are flying off the market with absorption rates of 2 months or less for anything under $3,000,000.(A standard healthy market is considered to have 6 months of standing inventory). The luxury market in the $3,000,000 to $10,000,000 range is bullish as well with supply levels of roughly 4 months. However, once you jump to the ultra exclusive at $15,000,000, we see a huge slow down in the market with absorption rates of over 15 months. *

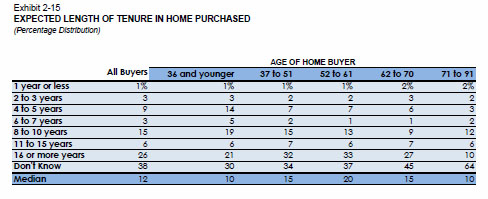

How long does the average homeowner stay put? Currently the median is 12 years and drops to 10 for buyers 36 years and younger; however, it jumps to 20 years for buyers aged 52 to 61. This is significantly higher than recent years (8.8 years in 2014 according to CAR)

Another important area to examine is the development of new homes. While the large development tracts are occurring more inland than our immediate area it is extremely important to our inventory levels, especially for first time buyers. December single family housing starts fell greater than expected, down 8.2% to a seasonally adjusted annual rate of 1.192 million units*, the largest drop since November 2016. While disappointing this is expected to be temporary; however, I would argue that both the increase in land and construction costs are going to continue to drag production far behind demand.

Lastly, interest rates are threatening to rise with 3 expected rate hikes this year. We are still at historical lows, but for many this has become the new normal. With an increase in rates there will be an associated decrease in purchasing power.

What does all of this mean in regards to real estate in 2018 and our inventory? It means that inventory will continue to be tight for our lower end product. In our neighborhood, that is anything $1,500,000 and under. Affordability issues and a lack of replacement properties will continue to push homeowners in this range to stay put unless life changing events prompt the move. On the flip side, our higher priced homes, think $5,000,000 and over will most likely see a gain in inventory and a slowdown in price growth.

In all, the same bills and regulations that will detract from the growth of the high-end market are also contributing to the lack of inventory and continued price growth in the lower end.

Written by AJ Olson Whitfield, realtor

For more information on our current market and how to make it work for you, join my mailing list.

Sources:

*For a detailed breakdown of the tax bill and homeownership click here: https://www.nar.realtor/tax-reform/the-tax-cuts-and-jobs-act-what-it-means-for-homeowners-and-real-estate-professionals#Current%20and%20Prospective%20Homeowners

*Source: Home Buyer and Seller Generational Trends Report 2017, https://www.nar.realtor/sites/default/files/reports/2017/2017-home-buyer-and-seller-generational-trends-03-07-2017.pdf

*Villa Real Estate founders, Steve High and Evan Corkett, keep running statistics on our local market pulled from the CRMLS

*https://www.census.gov/construction/nrc/pdf/newresconst.pdf

*https://www.cnbc.com/2018/01/18/housing-starts-dec-2017.html