By CONOR DOUGHERTY CONNECT

Dec. 22, 2013 7:28 p.m. ET

The strength of the housing recovery was a welcome surprise this year. If forecasters are correct, the sector is finally ready to start picking up the rest of the economy in 2014.

That’s because the market is changing in important ways.

Experts like Jed Kolko, chief economist at real-estate website Trulia, expect the mix of buyers in the coming year to shift to a combination of families moving up or buying their first homes—rather than the cash-only investors who have been driving sales in many cities.

Mortgage rates, which declined to historically low levels earlier this year, should continue to tick up. The Federal Reserve said last week that it would start pulling back on a bond-buying program that has helped keep a lid on long-term rates.

And home supply and demand are finally in a balance that should encourage building.

Add it all up and it means a market that’s less confusing than it was over the past few years, when prices tanked then shot back up as inventory thinned out. But it may also be less robust.

Here are three predictions economists are making about the housing market for the next year:

Home prices hit the ignition button in 2013. Don’t expect such a meteoric rise in 2014.

National home prices have risen between 5% and 13% over the past year, depending on which price index is used. White-hot markets in the West have seen home prices rise as much as 25%.

Economists say such heady gains aren’t happening again.

Stan Humphries, chief economist at real-estate site Zillow, is predicting his company’s national home-price index will rise by 3% in 2014, versus 5.2% over the past year through October. A Zillow survey of 110 economists in the fourth quarter of this year found an average forecast of a 4.3% gain for next year.

As a point of caution, the consensus opinion on housing has underestimated the market on the upside and downside throughout the recovery. The real-estate market has been more volatile over the past few years than in any postwar period, and Mr. Humphries notes that much would have to go right for his forecast to bear out.

Indeed, many experts have predicated their forecasts for modest price gains on interest rates rising and buyer competition thinning out. The inventory of distressed sales like foreclosures and short sales is in decline, so the bargains are mostly gone.

Sales of new and existing homes have slowed since summer’s end. The pace of further interest-rate increases in 2014—and the market’s ability to digest those—will play a major role in validating the recovery that began two years ago.

Mortgages may become easier to get. But they will also be more expensive.

Mortgage rates are set to end 2013 more than a full percentage point above year-ago levels, and many economists see them rising further in 2014 as the Fed continues to slow the bond-buying program that had pushed rates to record lows. Mr. Humphries says it’s “pretty much a sure thing” that mortgage rates will move above 5% amid an expanding economy and the withdrawal of the Fed stimulus.

Some economists also think mortgages should slowly become easier to get, though not in a dramatic way. Banks and mortgage lenders are facing big declines in volumes and profits as refinancing opportunities fade amid higher rates, which means competition to make loans to home buyers should increase. Rising home prices and falling mortgage delinquencies should also give lenders and mortgage-insurance companies more confidence.

The caution is that banks also have to digest a new cocktail of mortgage regulations set to come into force next month, and many big banks still face potential legal settlements over crisis-era mortgages that defaulted. Both of those forces could sap lenders’ appetites to make the credit box meaningfully wider to all but the most qualified borrowers.

Construction will finally boost overall growth.

Despite the recovery in home prices, building activity has remained depressed—a factor that has kept the economy from firing on all cylinders.

Now that housing inventory has been whittled down, however, builders are becoming more confident about breaking ground. At the same time, household formation should improve along with the steady gains in the job market, adding to the already-high demand for new homes and apartments.

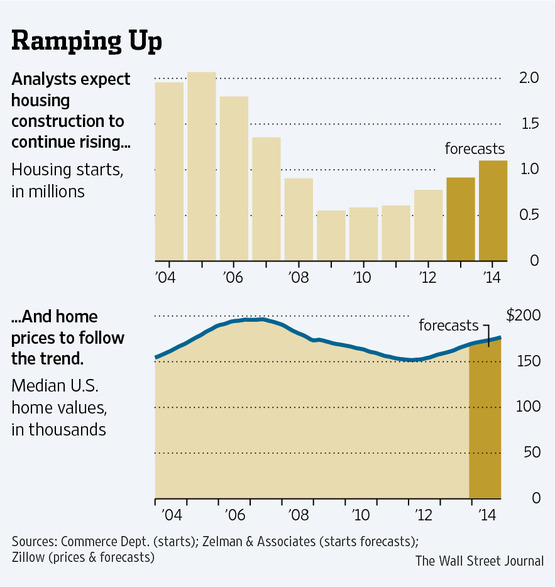

Housing starts were running at a seasonally adjusted annual rate of 1.09 million in November, up from a recessionary low of 554,000 in 2009 but still well below the 1.6 million average from 1995 to 2004—before the peak of the housing boom.

This muted pace reflects a cautious outlook from home builders who have had to contend with low household formation and an overhang of cheap existing homes whose prices they couldn’t compete with until recently.

Housing inventory bottomed in 2013, and higher prices have made it easier for builders to profitably sell new homes. Forecasting firm IHS Global Insight is projecting construction starts to rise to 1.1 million next year, while real-estate research firm Zelman & Associates is predicting about the same.

After a wild ride, housing is set to become more normal this coming year. That means homes will be less affordable, but it puts the sector back in line for a more healthy and measured pace of growth.

Source: Wall Street Journal

Homes for Sale in Newport Beach

Contact AJ Olson Whitfield for Showings (949) 433-8989

[idx-listings city=”Newport Beach” minprice=”950000″ statuses=”1″ propertytypes=”516″ orderby=”DateAdded” orderdir=”DESC” count=”20″ showlargerphotos=”true”]